My Local Taxes

Your Sedgwick County Tax Bill

If you own a home, land, or business in Sedgwick County, you receive a property tax bill from the Treasurer. You may pay in full in December or make half-payments in December and May. Your tax bill may also be paid as part of your mortgage payment each month.

Just because you pay your property taxes to Sedgwick County does not mean Sedgwick County keeps all that money. Instead, only about 25 cents out of every dollar goes to fund County services. The remainder goes to the state, cities, school districts, townships or other special districts based on your property address.

To help you understand more about how your property taxes are used, we have developed a quick way for you to see where the dollars go to support different government jurisdictions and how the Sedgwick County portion is used for County services. On the “My Local Taxes” application, you will find two sources of information: your "Total Taxes by Jurisdiction" and your "Sedgwick County Taxes at Work". CLICK HERE to go to the “My Local Taxes” application to get your personalized breakdown. All you need is your property address to proceed.

Historically, Sedgwick County has maintained one of the lowest property tax rates in comparison to the other 104 counties in the State. In the funding of the 2023 budget, Sedgwick County’s property tax levy of 29.368 mills was the second lowest metropolitan county, only behind Johnson County.

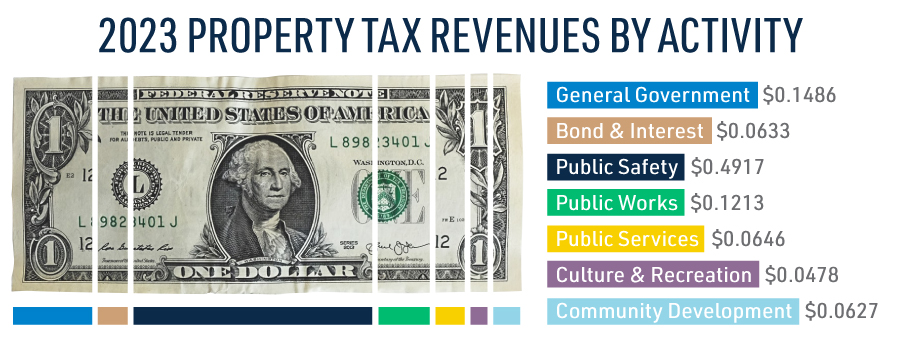

General Government includes legislative, executive, financial administration, law, personnel administration, elections, facility operations, information technology, and planning & zoning functions.

Bond & Interest includes payment of principal, interest and debt issuance cost.

Public Safety includes public safety administration, law enforcement, corrections, protective inspection, fire protection, EMS, emergency communications, civil preparedness and judicial functions.

Public Works includes road & bridges, storm drainage, waste disposal, weed control, and environmental resources functions.

Public Services includes mental health, public health, aging assistance, general assistance, and animal control functions.

Culture & Recreation includes parks, fairs & livestock, museums, and zoo functions.

Community Development includes education, economic development, & housing functions.

From roads to the jail to the zoo, Sedgwick County is working for you!